The Current State of the Gear and Transformer Market

By Kevin Coleman ~ March, 2024

Anecdotal results from the latest Pulse of Lighting report, a quarterly survey of electrical industry professionals (distributors, agent representatives, manufacturers), cites switchgear delays as one of the driving factors contributing to the low-growth outlook. Distributors have cited a slowing environment, and 40% of manufacturers respondents commenting that their backlogs have decreased, and that quoting activity has slowed, in addition to the quote-to-close cycle lengthening.

Despite ambitious energy transition goals and substantial government investments, studies predict that 25% of global renewable projects are in jeopardy due to long transformer lead times, supply chain bottlenecks and lack of global transformer production.

The National Association of Home Builders (NAHB) and other electric and construction organizations emphasized the ongoing issues and stated that average lead times to procure a distribution transformer have risen 443% since 2020, with some orders taking over a year to fill. The situation by all accounts, and as highlighted in the latest Pulse of Lighting report, has only worsened.

A recent Construction Dive article, “Supply Chain Headaches Persist 4 Years into Pandemic,” quotes Raylena Browning, VP of preconstruction at Tulsa, Oklahoma-based Manhattan Construction Co., estimating that electrical switchgear, generators and AV components have lead times 42 to 60 weeks. Availability is expected to remain limited for transformers and switchgear throughout 2024.

This is not only a utility problem; shortages of single-phase transformers and other components are preventing local jurisdictions from issuing building permits because there is no way to provide power to new homes and other buildings.

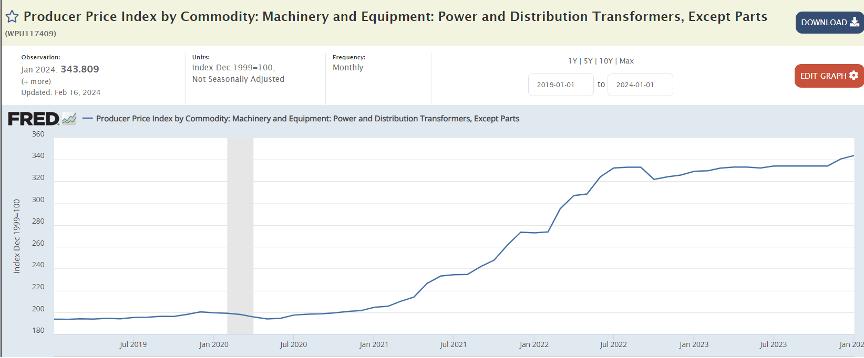

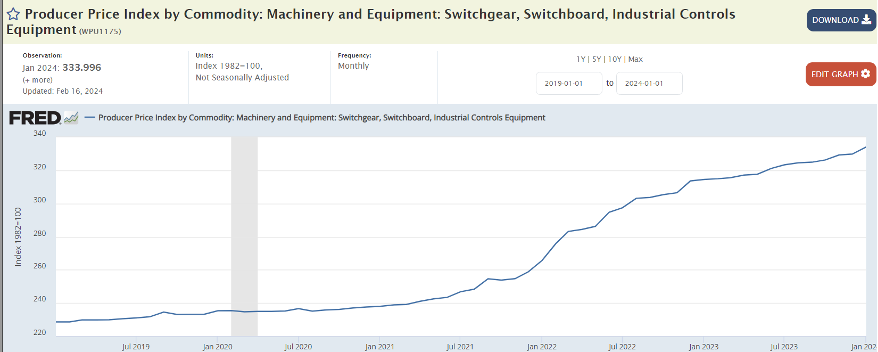

Price Increases

In near lockstep with the lead time increases, prices likewise also have increased dramatically. The U.S. Federal Reserve tracks commodity prices by producers, including Switchgears and Power and Distribution Transformers. Prices have risen significantly since July 2020. The Federal Reserve PPI Index for both commodities show a near steady and sharp price increase over the past three years.

Concerns Go Back Many Years

In the U.S., over 70% of transformers are over 25 years old. During the past few years, concerns about transformer supplies have extended beyond the large utility transmission and distribution units to smaller units used in local distribution networks. For example, an August 2022 survey by the American Public Power Association found that “production of distribution transformers is not meeting current demand” and that “many public power utilities are at a high risk of stocking out on transformers.” An Edison Electric Institute official stated at the time that supply constraints were even greater for smaller, distribution-level transformers than for large power transformers (LPTs), which are a critical component of the U.S. power grid. Some smaller utilities have reported that lead times for orders of distribution transformers grew from a few months in 2020 to well over a year in 2022, and that unit retail prices have increased by up to 400% or more.

A key factor limiting domestic transformer production is the availability of transformer component materials, particularly grain-oriented electrical steel (GOES), a specialty metal required for transformer cores. A 2020 Department of Commerce investigation found “insufficient or no domestic production capability for certain grades and qualities of GOES … for distribution transformers,” highlighting import dependence. The 2022 Department of Energy (DOE) Electric Grid Supply Chain Report found that only one U.S. GOES manufacturer exists and that the company could not meet domestic demand for the highest quality steel at prices comparable to imported GOES. This report also stressed the need for transformers to build a zero-carbon grid. The need to replace damaged transformers from recent storms (hurricanes, tornados, and fires) puts additional strain on U.S. transformer inventories.

Recent Government Initiatives Spur Demand and Seek Relief

Federal agencies have been sounding the alarm for several years, under both the Trump and Biden administrations. A 2022 DOE report concludes that the supply of new transformers must multiply dramatically for the nation’s grid to generate adequate electricity from wind and solar sources and to meet anticipated electric vehicle charging demand. Both the DOE and the U.S. Department of Commerce warned that transformer supply is a national security issue, even without clean energy transition.

In June 2022, President Biden issued a memorandum allowing DOE to use Defense Production Act authority to increase domestic production of transformers, among other electrical equipment. DOE has held listening sessions with stakeholders on the topic and also has joined with the Electricity Subsector Coordinating Council to establish a Supply Chain Tiger Team to identify supply chain challenges and potential solutions for grid components, including transformers. Some stakeholders and members of Congress have called for additional agency actions to increase transformer supplies, including:

- Temporarily waiving DOE’s energy efficiency standards for distribution transformers to reduce their required steel content;

- Having the Federal Emergency Management Agency (FEMA) identify existing transformer stockpiles among suppliers and utilities available for emergencies;

- Allocating funds in the Inflation Reduction Act, for wage subsidies to transformer manufacturing workers to increase domestic production; and

- The Infrastructure Investment and Jobs Act requiring the DOE to assess the potential development and storage of an inventory of high-voltage transformers and to provide an update of related industry efforts, which have not been delivered to date.

Some Members of the 117th Congress have introduced additional legislation intended to address transformer supplies. Specifically, in January 2024, Senators Sherrod Brown (D-OH) and Ted Cruz (R-TX) introduced new legislation with broad bipartisan support – S.3627, The Distribution Transformer Efficiency & Supply Chain Reliability Act of 2024,–that would bolster the U.S. transformer supply chain. This bill is currently in the House Energy and Commerce Committee (HR.7171).

The bill would prevent the new DOE rule from taking effect, which would require all distribution transformers to shift from the industry standard GOES cores to amorphous cores. GOES currently accounts for more than 95% of the domestic distribution transformer market, and manufacturers’ production lines are tooled for designs to produce GOES. Furthermore, such a recalibration of the supply chain will further delay manufacturing timelines – currently estimated at 18 months to two years.

HR.7171 instead creates a new standard that provides increased energy efficiency of transformers at levels that preserve market opportunities for GOES and amorphous cores. It has broad industry support including the National Rural Electric Cooperative Association, National Electrical Manufacturers Association, Edison Electric Institute, NAHB, Leading Builders of America, United Automobile, Aerospace and Agricultural Implement Workers of America, UAW Local 3303, and UAW Local 4104. This highlights the sometimes-conflicting direction of government policy, which while focused on the future, puts significant strain on current supplies, rippling down to individual project delays.

Recent Industry Initiatives

To address the shortage, in January 2024 Siemens Energy announced a $150 million investment to build the first Siemens Energy Transformer production facility in the U.S. in Charlotte, NC. The press release cited that only 20% of U.S. large power transformer demand is met by domestic supply (approximately right manufacturers), with lead times of up to five years. Previously, in 2022, Hitachi Energy announced that it would spend $37 million to expand its transformer plant in South Boston, VA, to meet power demands from renewable energy sites, cloud computing, bitcoin mining and data center operations.

Conclusion

While the shortage of critical switchgear and transformer products has clearly been recognized, and actions by both government and industry fronts are in process, shortages are expected to remain throughout 2024 and into 2025. At the same time, demand continues to grow, driven by replacement of obsolete and failing equipment, natural disasters and grid modernization and electrification. In the meantime, distributors and contractors can take steps to alleviate the situation:

- Utilities can remove underutilized, unused, and repairable transformers and refurbish them.

- Contractors should consider alternative designs – pole-mounted vs. pad-mounted or alternative enclosures to reduce cost and lead time.

- Stakeholders should communicate transparently with contractors, distributors, manufacturers, suppliers, and utility companies to share information about demand, supply constraints, and delivery timelines to help identify alternative solutions and prioritize critical projects.

- Contractors and distributors can explore sourcing transformers and switchgear from alternative suppliers or regions.

- Contractors and distributors should maintain strategic inventories of essential components. Regularly assess inventory levels, monitor lead times, and adjust stock levels based on market conditions.

- Contractors can explore local manufacturing or assembly options. Setting up small-scale production facilities for critical components may help bridge supply gaps.

- All stakeholders should invest in training and skilled labor to prepare for a longer-term solution that can address multiple challenges. By enhancing the skills of technicians and electricians to handle repairs, maintenance, and minor modifications, the educated labor force can optimize existing equipment and extend its lifespan.