2024 DISC Outlook

DISC’s forecast for 2023 predicted a mild recession with FED interest rate hikes acting as economic brakes and curbing inflation. However, expectations were proven wrong with the American economy demonstrating overall resilience throughout the year. Thanks to strategic implementations of the CARES and CHIPS acts, the national and electrical industry economies alike experienced a boost, surpassing forecasts. Although 2023 wasn’t a robust year, it can be characterized as reasonable.

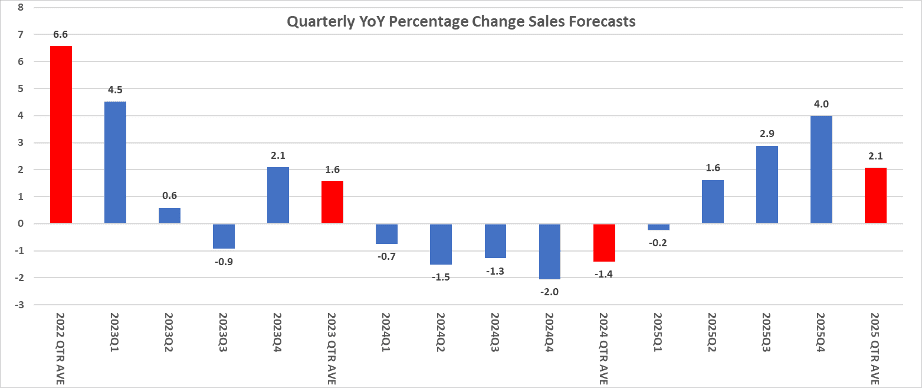

In assessing the final figures of 2023, it appears the year will close with a modest 1.5% growth over 2022, despite industry prices experiencing a 1.7% decline on a year-over-year calculation (YoY). The economic landscape, shaped by a combination of external factors, paints a nuanced picture of the overall performance.

Looking ahead to 2024 and transitioning from year-end 2023, a prevailing sense of uncertain cautiousness characterizes the outlook. In particular, the electrical distribution market, which is estimated to conclude 2023 at $137.5 billion is poised to slightly decline projecting a total value of $135.6 billion for 2024, down 1.4% YoY. It is important to note that this forecast is not without its risks and uncertainties.

Delving into DISC’s quarterly forecast for the electrical distribution community in 2024, it is crucial to acknowledge the potential risks looming on the horizon. Our forecast remains sensitive to an array of factors, and we vigilantly monitor unfolding events. These include the ongoing trajectory of interest rate hikes, labor unrest, geopolitical tensions such as the Ukraine/Russia and Israel/Gaza conflicts, immigration challenges at the Southern border, political polarization, fluctuations in oil prices, FED policy shifts, and the inherent uncertainties surrounding copper markets. Moreover, we recognize the possibility of unforeseen black swan events that may significantly impact our projections.

In conclusion, despite an initial expectation of a recession, the American economy showcased resilience in 2023 with the help of economic stimulus packages. However, caution prevails as we approach 2024, given the multitude of risks and uncertainties in various areas that could shape the future economic landscape. There remains plenty of opportunity for market share growth and targeted opportunity. DISC considers four verticals, Construction, Industrial, Institutional, and utility to provide guidance to assist with market sizing, share calculations, opportunity finding, and resource allocations.

Christian Sokoll—2024 DISC Outlook and 2023 Recap